Accident Year Vs Calendar Year

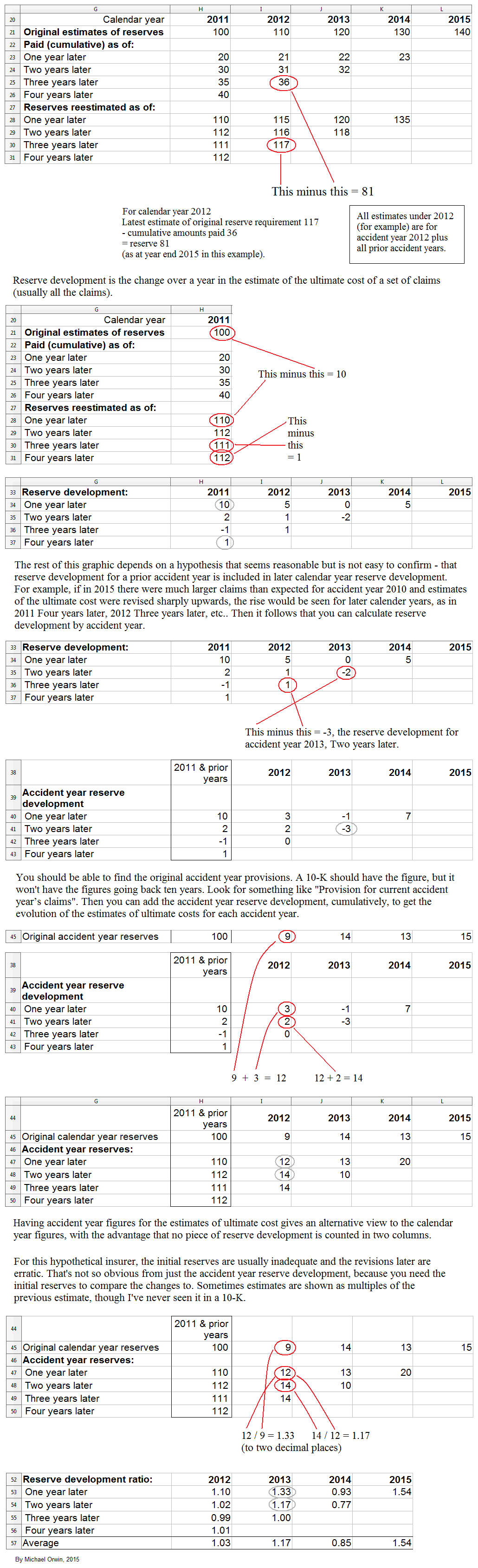

Accident Year Vs Calendar Year - Web this video describes the difference between accident year and calendar year with the help of an example. Web in 2018, the accident year ratio of the u.s. Let’s say dec 2021 you have a policy start but there’s an accident mar 2022. Web 188 loss ratios introduction up until the early to mid 1970’s, there was one basic method used to calculate calendar year loss ratios. Web the 87% ratio is based on calendar year figures and not accident year. Web as the nba calendar year progresses, stay up to date with the latest news happening around the league with our dallasbasketball.com tracker. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have been incurred. As one can see in the above chart, 2021 had a cr of 91%, and 86% in 2022. Accident year and calendar year are common. Web year loss trends by creating a situation where the calendar year loss trends are inaccurate. Let’s say dec 2021 you have a policy start but there’s an accident mar 2022. Web year loss trends by creating a situation where the calendar year loss trends are inaccurate. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web also known as an underwriting year experience or accident year experience,. The results show that the calendar year loss trends can be distorted significantly by. Property and casualty insurance industry was 100 percent, and rose to 101 percent in the first quarter of 2019. Web in 2018, the accident year ratio of the u.s. This consisted of the paid losses. Web accident year data refers to a method of arranging loss. Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a book of business, so that all losses associated with. Reserve reductions from previous years and prior investments maturing can influence. Web in 2018, the accident year ratio of the u.s. Web as the nba calendar year. Let’s say dec 2021 you have a policy start but there’s an accident mar 2022. Property and casualty insurance industry was 100 percent, and rose to 101 percent in the first quarter of 2019. Web the calendar year cr is what ncci measures and reports. Web the 87% ratio is based on calendar year figures and not accident year. Most. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have been incurred. Accident year and calendar year are common. This consisted of the paid losses. Property and casualty insurance industry was 100 percent, and rose to 101 percent in the first quarter of 2019. Most. Most reserving methodologies assume that the ay and dy directions are independent. Web as the nba calendar year progresses, stay up to date with the latest news happening around the league with our dallasbasketball.com tracker. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have. Let’s say dec 2021 you have a policy start but there’s an accident mar 2022. Web the 87% ratio is based on calendar year figures and not accident year. Web the calendar year cr is what ncci measures and reports. Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of. Web accident year (ay), development year (dy), and payment/calendar year (cy). Web year loss trends by creating a situation where the calendar year loss trends are inaccurate. Most reserving methodologies assume that the ay and dy directions are independent. Web an explanation of the differences between calendar year, accident year, exposure year and underwriting year american institute of marine underwriters. Web accident year data refers to a method of arranging loss and vulnerability data of into insurer other group starting insurers or within one book of business, so that all damages. Web usually these deviate when a policy starts one year but an accident occurs the following year. Accident year and calendar year are common. Web year loss trends by. Web an explanation of the differences between calendar year, accident year, exposure year and underwriting year american institute of marine underwriters what year is it? Web the calendar year cr is what ncci measures and reports. Web accident year (ay), development year (dy), and payment/calendar year (cy). Web usually these deviate when a policy starts one year but an accident. Web as the nba calendar year progresses, stay up to date with the latest news happening around the league with our dallasbasketball.com tracker. Web an explanation of the differences between calendar year, accident year, exposure year and underwriting year american institute of marine underwriters what year is it? Web 188 loss ratios introduction up until the early to mid 1970’s, there was one basic method used to calculate calendar year loss ratios. As one can see in the above chart, 2021 had a cr of 91%, and 86% in 2022. Web we nowrewrite(5) for accidentyear 1 as follows: Accident year and calendar year are common. Most reserving methodologies assume that the ay and dy directions are independent. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web the 87% ratio is based on calendar year figures and not accident year. Let’s say dec 2021 you have a policy start but there’s an accident mar 2022. Web the calendar year cr is what ncci measures and reports. The results show that the calendar year loss trends can be distorted significantly by. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have been incurred. Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a book of business, so that all losses associated with. Web this video describes the difference between accident year and calendar year with the help of an example. Web year loss trends by creating a situation where the calendar year loss trends are inaccurate. Web accident year (ay), development year (dy), and payment/calendar year (cy). Reserve reductions from previous years and prior investments maturing can influence. This consisted of the paid losses. Web accident year data refers to a method of arranging loss and vulnerability data of into insurer other group starting insurers or within one book of business, so that all damages. Web usually these deviate when a policy starts one year but an accident occurs the following year. Web this video describes the difference between accident year and calendar year with the help of an example. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have been incurred. Most reserving methodologies assume that the ay and dy directions are independent. Web accident year data refers to a method of arranging loss and exposure data of an insurer or group of insurers or within a book of business, so that all losses associated with. Web the calendar year cr is what ncci measures and reports. Web we nowrewrite(5) for accidentyear 1 as follows: Web year loss trends by creating a situation where the calendar year loss trends are inaccurate. Web 188 loss ratios introduction up until the early to mid 1970’s, there was one basic method used to calculate calendar year loss ratios. Web as the nba calendar year progresses, stay up to date with the latest news happening around the league with our dallasbasketball.com tracker. Accident year and calendar year are common. Web an explanation of the differences between calendar year, accident year, exposure year and underwriting year american institute of marine underwriters what year is it? Web what is calendar year experience? Web accident year data refers to a method of arranging loss and vulnerability data of into insurer other group starting insurers or within one book of business, so that all damages. Property and casualty insurance industry was 100 percent, and rose to 101 percent in the first quarter of 2019. Web the 87% ratio is based on calendar year figures and not accident year.Accident Year Vs Calendar Year Printable Calendar 20222023

Accident Year Vs Calendar Year Student calendar, Yearly calendar

Accident Year Vs Calendar Year Calendar Printables Free Templates

Accident Year Vs Calendar Year Month Calendar Printable

Ppt Introduction To Reinsurance Reserving Powerpoint Inside Accident

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Accident Year Vs Calendar Year Calendar Printables Free Templates

Casualty Actuarial Society Loss Reserve Seminar Ppt Download With

Policy Year Experience In Accident Year Vs Calendar Year Printable

Casualty Actuarial Society Loss Reserve Seminar Ppt Download With

The Results Show That The Calendar Year Loss Trends Can Be Distorted Significantly By.

Let’s Say Dec 2021 You Have A Policy Start But There’s An Accident Mar 2022.

Web In 2018, The Accident Year Ratio Of The U.s.

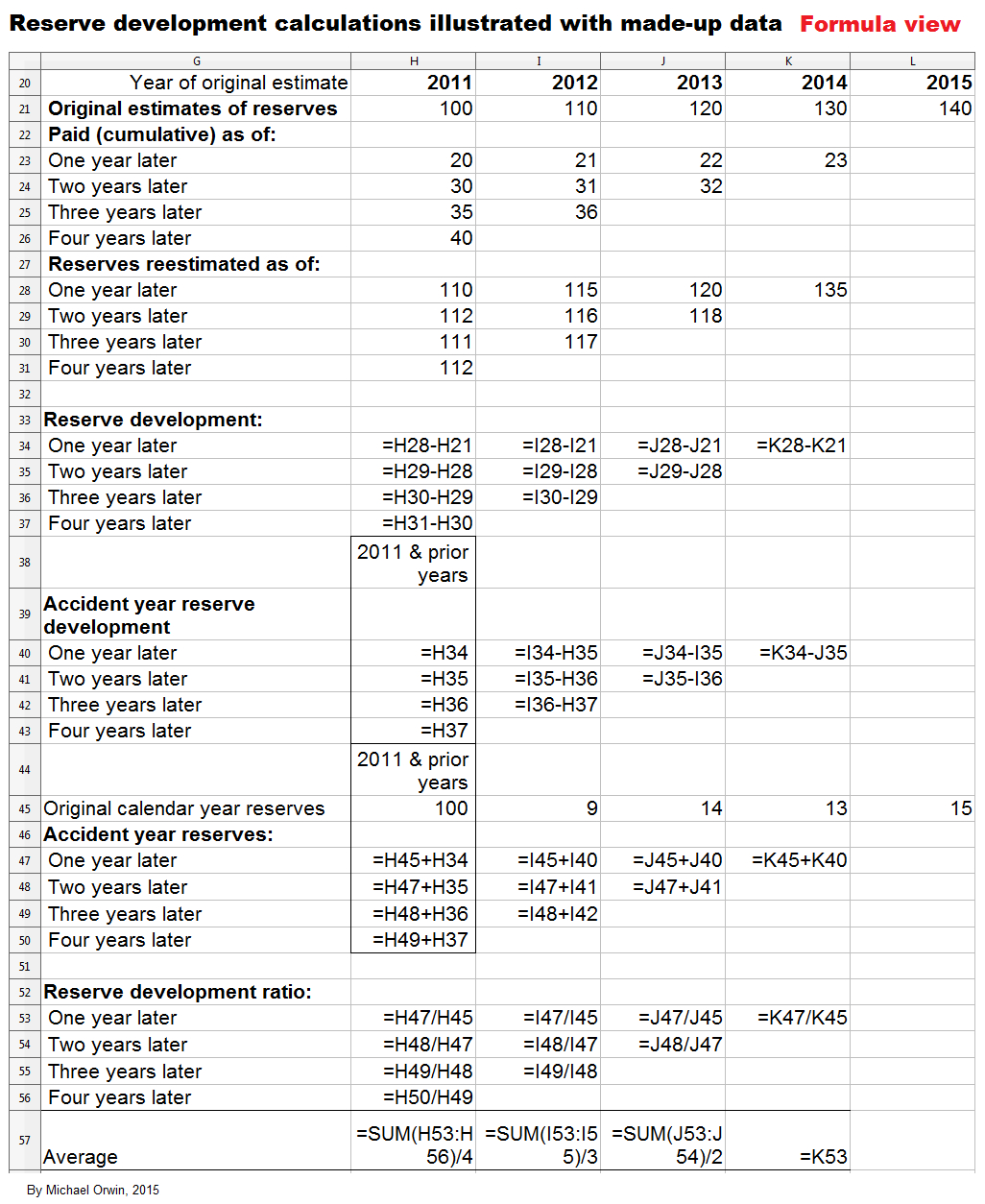

Web Accident Year (Ay), Development Year (Dy), And Payment/Calendar Year (Cy).