Calendar Put Spread

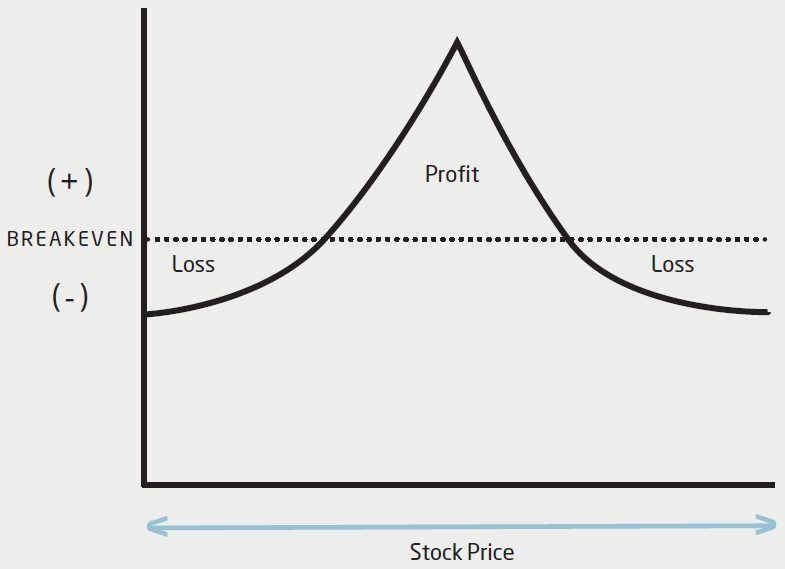

Calendar Put Spread - Web 6 hours agofar otm put spread bunds. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. Web calendar spreads defined. A calendar spread is a strategy used in options and futures trading: Rxv3 126/124 ps, bought for 13.5 in 5k. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. Bullet markets fixed income news homepage. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Depending on the near term outlook, either. Go to insert > calendar. Web calendar spreads defined. 8 words to read the. Go to insert > calendar. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Web reverse calendar put spread: 8 words to read the. Web type your message, then put the cursor where you want to insert the calendar info. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. It’s a cross between a long calendar spread. 8 words to read the. Rxv3 126/124 ps, bought for 13.5 in 5k. Web a calendar put spread is created when long term put options are bought and near term put options with the same strike price are sold. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the. It’s a cross between a long calendar spread with puts and a short put spread. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. A calendar spread is a strategy used in options and futures trading: Web a calendar put spread is. Web 6 hours agofar otm put spread bunds. A calendar spread is a strategy used in options and futures trading: Web a calendar put spread is created when long term put options are bought and near term put options with the same strike price are sold. Rxv3 126/124 ps, bought for 13.5 in 5k. It starts out as a time. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Web reverse calendar put spread: This. Web calendar spreads defined. Rxv3 126/124 ps, bought for 13.5 in 5k. It’s a cross between a long calendar spread with puts and a short put spread. Choose the calendar that you want to send, then select the date. In the calendar properties dialog box, click add. Web 6 hours agofar otm put spread bunds. Web what's a calendar spread? In the calendar properties dialog box, click add. Choose the calendar that you want to send, then select the date. This strategy will focus on puts. Choose the calendar that you want to send, then select the date. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. Go to insert > calendar. Web reverse calendar put spread: It’s a cross between a long calendar spread with. Web what's a calendar spread? 8 words to read the. Go to insert > calendar. Choose the calendar that you want to send, then select the date. In the calendar properties dialog box, click add. A calendar spread is a strategy used in options and futures trading: Web calendar spreads defined. A put calendar is best used when the short. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. (in publisher 2010, click calendars under most popular.) click the calendar that you. It’s a cross between a long calendar spread with puts and a short put spread. Depending on the near term outlook, either. In your calendar, select share. Choose the calendar that you want to send, then select the date. Web 6 hours agofar otm put spread bunds. Web a calendar put spread is created when long term put options are bought and near term put options with the same strike price are sold. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same. Bullet markets fixed income news homepage. Go to insert > calendar. Web what's a calendar spread? Rxv3 126/124 ps, bought for 13.5 in 5k. In the calendar properties dialog box, click add. It starts out as a time decay play. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. The calendar put spread is very similar to the calendar call spread, and both of these strategies aim to use the effects of time decay to profit from a. Bullet markets fixed income news homepage. Web reverse calendar put spread: On the file menu, click new. Rxv3 126/124 ps, bought for 13.5 in 5k. A calendar spread is a strategy used in options and futures trading: Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration. It’s a cross between a long calendar spread with puts and a short put spread. Choose the calendar that you want to send, then select the date. Web 6 hours agofar otm put spread bunds. Go to insert > calendar. In the calendar properties dialog box, click add. Depending on the near term outlook, either. Web to share your outlook calendar on outlook.com, first save it as an icalendar (.ics file), import it into outlook.com, then share it with the people who need to see it. For example, if a stock is trading at or above $50, and an investor believes the stock will stay above $50 in the near future, a put. A calendar spread, also known as a horizontal spread, is created with a simultaneous long and short position in options on the same.Calendar Put Spread Options Edge

Pair Trading Strategy Spread Trading Strategy Calendar Spread

Glossary Archive Tackle Trading

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

The Long Calendar Spread Explained 1 Options Trading Software

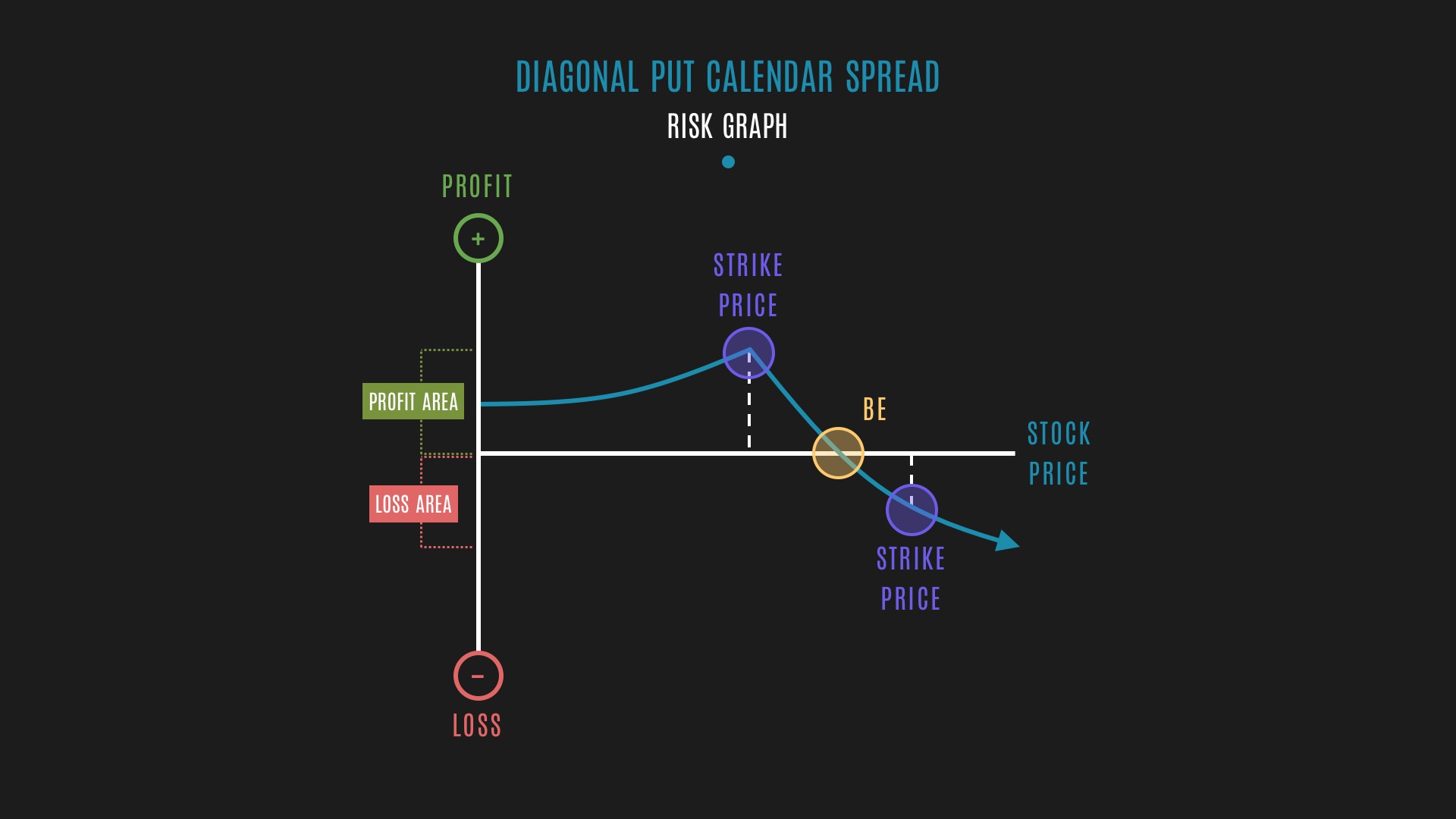

Glossary Diagonal Put Calendar Spread example Tackle Trading

Options Trading Made Easy Ratio Put Calendar Spread

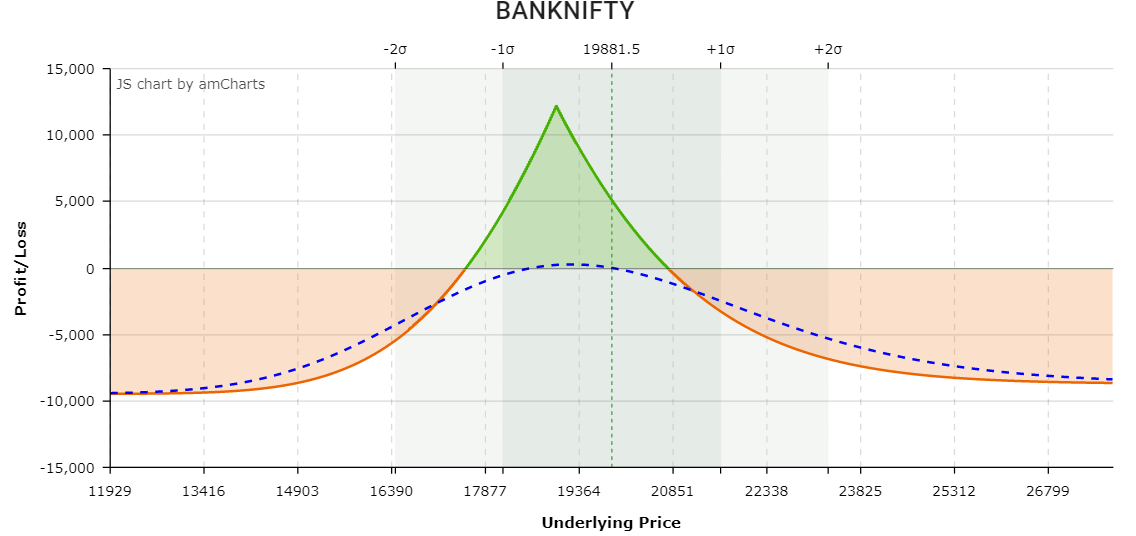

Long Calendar Spreads Unofficed

Pin on Option Trading Strategies

Web A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month Later.

A Put Calendar Is Best Used When The Short.

Web Type Your Message, Then Put The Cursor Where You Want To Insert The Calendar Info.

Web A Calendar Put Spread Is Created When Long Term Put Options Are Bought And Near Term Put Options With The Same Strike Price Are Sold.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)