Call Calendar Spread

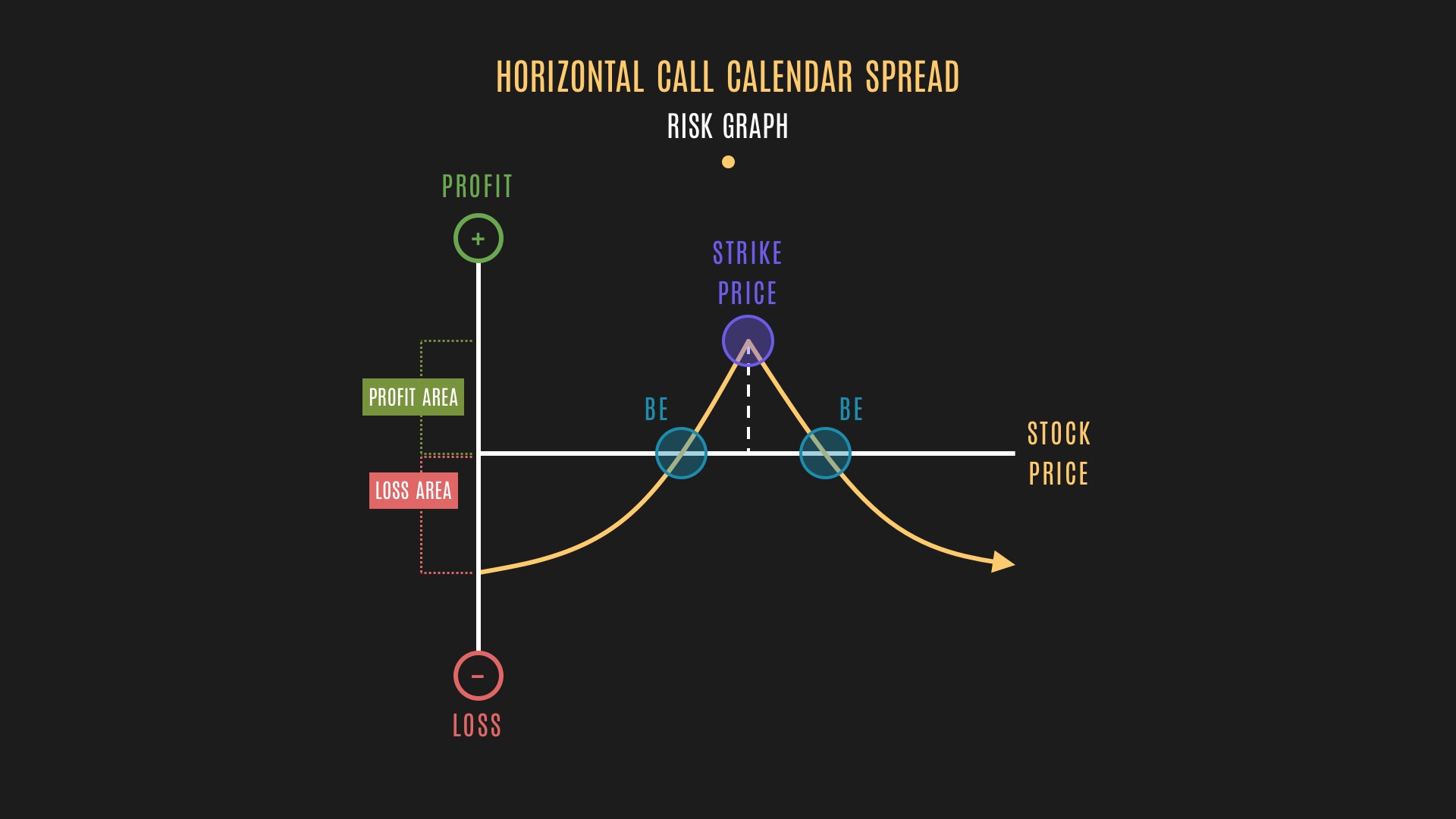

Call Calendar Spread - Web trading calendar spreads: Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Choose the calendar that you want to send, then select the date. The calendar spread strategy can be effective during sideways markets and periods of. They can be created with either. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Learn the strategy, roll decision, and risks. Web type your message, then put the cursor where you want to insert the calendar info. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Go to insert > calendar. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. They can be created with either. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Choose the calendar that you want to send, then select the date. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Choose the calendar that you want to send, then select the date. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Learn the strategy, roll decision,. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Web wiktionary (0.00 / 0 votes) rate. An options strategy or position. They can be created with either. The calendar spread strategy can be effective during sideways markets and periods of. The strategy most commonly involves. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Learn the strategy, roll decision, and risks. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Choose the calendar that you want to send, then select the date. Web the calendar spread refers to a. Web wiktionary (0.00 / 0 votes) rate these synonyms:. An options strategy or position. Web type your message, then put the cursor where you want to insert the calendar info. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web type your message, then put the cursor where you want to insert the calendar info. Web the calendar call spread is a neutral options trading strategy, which means. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Selling a call calendar spread consists of. Go to insert > calendar. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web trading calendar spreads: Web what is a call calendar spread. Choose the calendar that you want to send, then select the date. The calendar spread strategy can be effective during sideways markets and periods of. Web type your message, then put the cursor where you want to insert the calendar info. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web trading calendar spreads: Selling a call calendar spread consists of buying one call option and selling a second call option with. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. An options strategy or position. Web trading calendar spreads: Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. The calendar spread strategy can be effective during sideways markets and periods of. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Choose the calendar that you want to send, then select the date. Go to insert > calendar. Learn the strategy, roll decision, and risks. The strategy most commonly involves. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web what is a call calendar spread. Web wiktionary (0.00 / 0 votes) rate these synonyms:. Web type your message, then put the cursor where you want to insert the calendar info. They can be created with either. Learn the strategy, roll decision, and risks. An options strategy or position. They can be created with either. Selling a call calendar spread consists of buying one call option and selling a second call option with a more distant expiration. Web trading calendar spreads: Web what is a call calendar spread. The calendar spread strategy can be effective during sideways markets and periods of. Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price,. Web the calendar call spread is a neutral options trading strategy, which means you can use it to generate a profit when the price of a security doesn't move, or only moves a little. Go to insert > calendar. Web the calendar spread refers to a family of spreads involving options of the same underlying stock, same strike prices, but different expiration months. Web type your message, then put the cursor where you want to insert the calendar info.Glossary Definition Horizontal Call Calendar Spread Tackle Trading

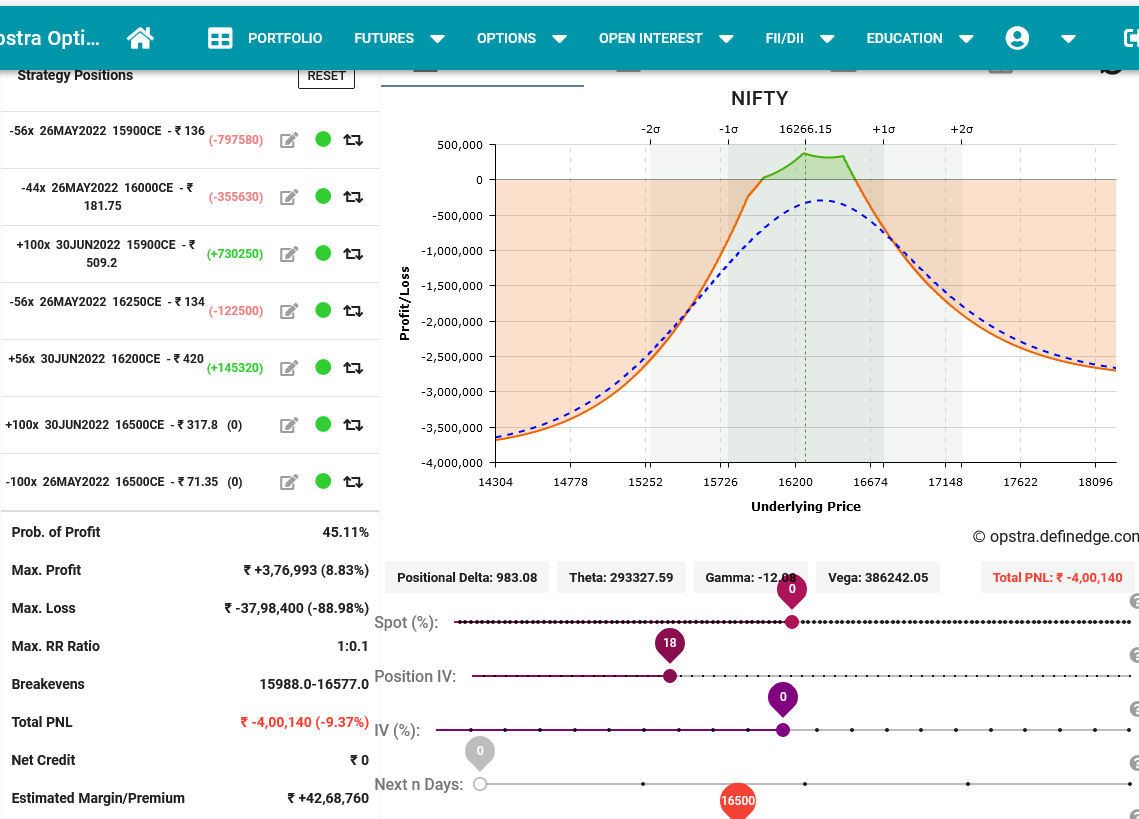

How to salvage a Call Calendar spread that has gone wrong? Stocks Talk

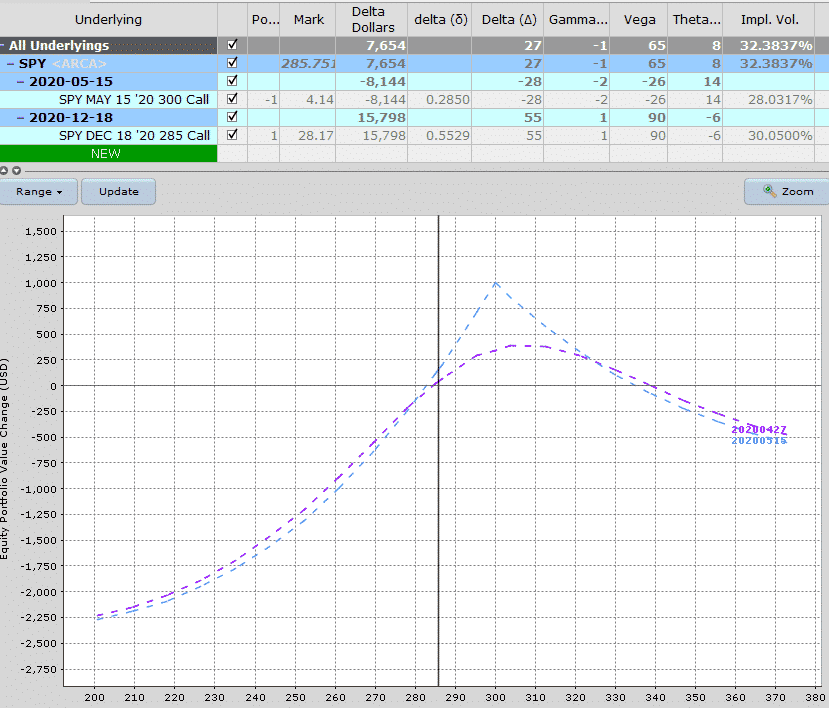

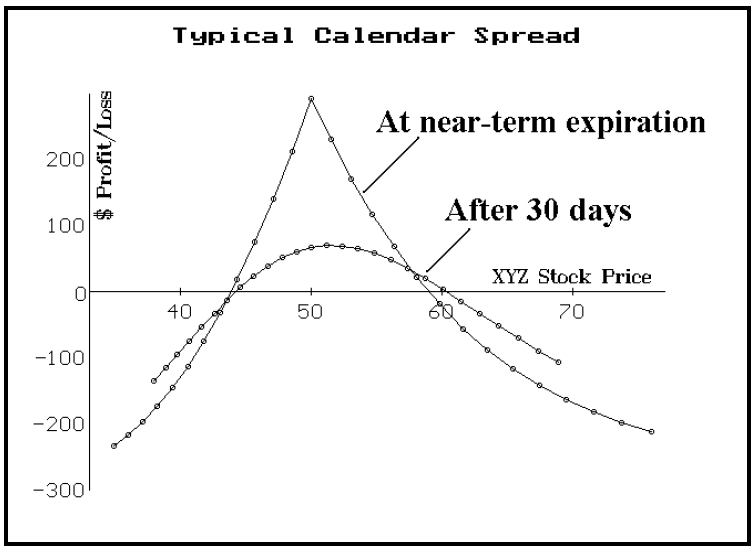

Calendar Spreads 101 Everything You Need To Know

Diagonal Call Calendar Spread Smart Trading

How to Trade Options Calendar Spreads (Visuals and Examples)

Call Calendar Spread

Calendar Call Spread Options Edge

The Dual Calendar Spread (A Strategy for a Trading Range Market) (1106

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Glossary Archive Tackle Trading

Choose The Calendar That You Want To Send, Then Select The Date.

Web Wiktionary (0.00 / 0 Votes) Rate These Synonyms:.

The Strategy Most Commonly Involves.

![Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019ad90afc0a18011924af0_3Ui8KuFuRxcjUyFQ2mvscNmGIXALxE0ESnrXkoAAqNejP5Ygrj-dyv3Kfo-1jmOjFg2axgrXs-MriQsNl-6is4rU-lDczPVaDzlttqUjTEJIvT6pRF0GK8qSlYVoNo6r5r07P-gi.png)